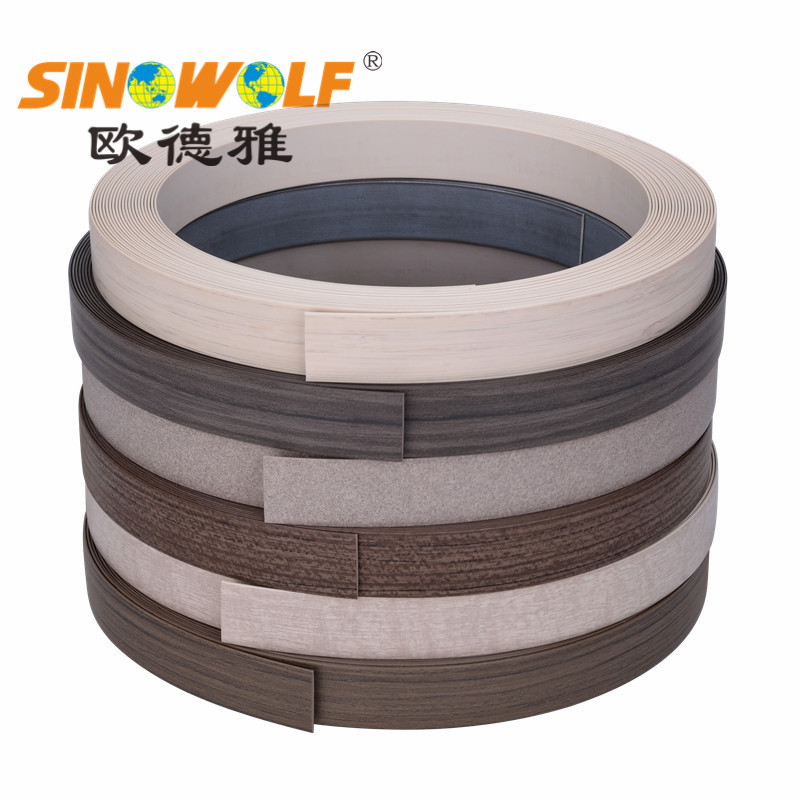

PVC Super Matt Edge Banding we adopt quality PVC raw material, German UV and ink, JOWAT primer. Thousand designs, 0.35-3.0mm thickness and 12-620mm width. All high-edge raw materials to make sure our PVC Matt Edge Banding is the first class products in this world. Sinowolf Plastic Dekor CO., LTD always focus on producing best quality edge band. Using high-end raw materials, all chemical additives import from Europe, to make sure our plastic edge banding keep stable quality 3-5 years. Our products range include PVC edge band, ABS edge band, 3D PMMA acrylic edge band, Aluminum edge band.

PVC Super Matt Edge Banding, PVC Matt Edge Banding, Matt Finish PVC Edge Banding, Supper Matt Edge Banding, PVC edge Banding Matt, Matt Edge Banding PVC Edging

Sinowolf Plastic Dekor Co., Ltd , http://www.sinowolfdekor.com